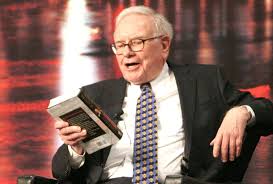

Exploring the Wisdom of Warren Buffett through His Books

Warren Buffett, widely regarded as one of the most successful investors in the world, has not only amassed a fortune but has also shared his wisdom and insights through various books. Let’s delve into some of the key works that offer a glimpse into the mind of this legendary investor.

“The Essays of Warren Buffett: Lessons for Corporate America”

This book, compiled by Lawrence A. Cunningham, is a collection of Buffett’s letters to Berkshire Hathaway shareholders over the years. It provides valuable insights into his investment philosophy, approach to business, and principles for long-term success.

“Buffett: The Making of an American Capitalist” by Roger Lowenstein

In this biography, Lowenstein offers a detailed account of Buffett’s life, from his early days as an investor to his rise as a business magnate. Readers gain an understanding of Buffett’s mindset, decision-making process, and the principles that have guided his success.

“The Intelligent Investor” by Benjamin Graham

While not written by Buffett himself, this classic investment book heavily influenced his approach to investing. Graham’s timeless wisdom on value investing and risk management has shaped Buffett’s investment philosophy and serves as a cornerstone for aspiring investors.

“Warren Buffett’s Ground Rules” by Jeremy C. Miller

This book distills Buffett’s investment principles into actionable rules that investors can apply in their own portfolios. Miller provides valuable commentary and analysis on how Buffett identifies opportunities, assesses risks, and builds wealth over time.

Exploring Warren Buffett’s books offers not only financial insights but also lessons in discipline, patience, and long-term thinking. Whether you’re a seasoned investor or someone looking to learn from the best in the business, delving into these works can provide invaluable knowledge and inspiration.

Unlocking Financial Mastery: 7 Key Benefits of Reading Warren Buffett Books

- Insights from a successful investor

- Practical investment advice

- Timeless wisdom on value investing

- Guidance on risk management

- Inspiration for long-term success

- Clear explanations of complex concepts

- Applicable principles for personal finance

Unpacking the Challenges: A Critical Examination of Warren Buffett’s Investment Literature

- Some of Warren Buffett’s books may contain complex financial concepts that could be challenging for beginners to grasp.

- The investment strategies outlined in Buffett’s books may not always be suitable for every individual’s financial goals or risk tolerance.

- Readers looking for quick-fix investment tips may find Buffett’s books focused more on long-term principles rather than short-term gains.

- Critics argue that the success of Warren Buffett is unique and may not be easily replicable by the average investor, despite the insights shared in his books.

Insights from a successful investor

Warren Buffett’s books offer invaluable insights from a successful investor who has navigated the complex world of finance with remarkable acumen and consistency. Through his writings, Buffett shares his wealth of experience, wisdom, and proven strategies that have propelled him to the pinnacle of investment success. Readers have the opportunity to gain a deeper understanding of his thought processes, decision-making techniques, and fundamental principles that have guided his investment journey. By tapping into Buffett’s insights, aspiring investors can learn valuable lessons on how to approach markets, assess opportunities, manage risks effectively, and ultimately strive for long-term financial success.

Practical investment advice

Warren Buffett’s books offer a wealth of practical investment advice that resonates with both seasoned investors and novices in the financial world. Through his writings, Buffett simplifies complex investment concepts, offering clear and actionable guidance on how to identify undervalued stocks, assess risks, and build a successful investment portfolio. His emphasis on long-term value investing, patience, and disciplined decision-making provides readers with a solid framework for navigating the unpredictable landscape of the stock market. By distilling his decades of experience into practical insights, Warren Buffett equips readers with the knowledge and tools necessary to make informed investment decisions and achieve long-term financial success.

Timeless wisdom on value investing

Warren Buffett’s books offer a timeless wisdom on value investing that transcends market trends and economic fluctuations. Through his insightful writings, Buffett emphasises the importance of fundamental analysis, long-term perspective, and the intrinsic value of companies. His approach to value investing focuses on identifying undervalued assets and holding onto them for the long haul, rather than chasing short-term gains. This enduring philosophy serves as a guiding light for investors seeking sustainable wealth creation and financial success in the ever-changing landscape of the stock market.

Guidance on risk management

Warren Buffett’s books offer invaluable guidance on risk management, a key aspect of successful investing. Through his writings and investment philosophy, Buffett emphasises the importance of understanding and mitigating risks in the financial markets. His emphasis on margin of safety, long-term perspective, and thorough analysis of potential investments serves as a beacon for investors seeking to navigate the complexities of risk in their portfolios. By studying Buffett’s insights on risk management, readers can learn how to make informed decisions, protect their capital, and maximise returns over time.

Inspiration for long-term success

Warren Buffett’s books serve as a wellspring of inspiration for those seeking long-term success in various aspects of life, not just in investing. Through his writings, Buffett imparts valuable lessons on patience, perseverance, and the importance of thinking strategically for the future. His emphasis on sustainable growth, enduring value, and prudent decision-making encourages readers to adopt a mindset focused on long-term goals rather than short-term gains. By drawing from Buffett’s wisdom, individuals are inspired to cultivate a disciplined approach towards achieving lasting success in their personal and professional endeavours.

Clear explanations of complex concepts

Warren Buffett’s books excel in providing clear explanations of complex investment concepts, making them accessible to readers of all levels of expertise. Through his straightforward writing style and real-world examples, Buffett demystifies intricate financial principles, such as value investing and risk management, allowing readers to grasp these concepts with ease. By breaking down complex ideas into digestible insights, Buffett’s books empower individuals to enhance their understanding of the intricate world of investing and make informed decisions with confidence.

Applicable principles for personal finance

Warren Buffett’s books offer a treasure trove of applicable principles for personal finance that can benefit individuals seeking to manage their money wisely. Through his timeless wisdom on value investing, risk management, and long-term wealth building, Buffett provides practical insights that can be applied to everyday financial decisions. By learning from Buffett’s principles, readers can gain a deeper understanding of how to grow their wealth steadily, make informed investment choices, and cultivate a mindset focused on sustainable financial success.

Some of Warren Buffett’s books may contain complex financial concepts that could be challenging for beginners to grasp.

Some of Warren Buffett’s books may pose a challenge for beginners due to the inclusion of complex financial concepts that require a certain level of understanding and experience in the field of investing. The intricate nature of these concepts could potentially overwhelm those who are new to the world of finance, making it difficult for them to fully grasp the principles and strategies outlined in Buffett’s writings. However, with dedication, patience, and a willingness to learn, beginners can gradually build their knowledge and comprehension to better appreciate the valuable insights offered by Warren Buffett in his books.

The investment strategies outlined in Buffett’s books may not always be suitable for every individual’s financial goals or risk tolerance.

While Warren Buffett’s books offer valuable insights into investment strategies and principles, it is important to acknowledge that his approach may not align with every individual’s financial goals or risk tolerance. Buffett’s emphasis on long-term value investing and patience may not suit those seeking quick returns or high-risk investments. It is crucial for readers to critically evaluate their own financial situation, objectives, and risk appetite before implementing any of Buffett’s strategies outlined in his books. Tailoring investment approaches to personal circumstances is essential to achieving financial success and security.

Readers looking for quick-fix investment tips may find Buffett’s books focused more on long-term principles rather than short-term gains.

Readers seeking quick-fix investment tips may be disappointed when delving into Warren Buffett’s books, as his focus is predominantly on long-term principles rather than short-term gains. Buffett’s investment philosophy emphasises patience, discipline, and a strategic approach to wealth-building over time. While his insights offer valuable lessons in sustainable investing practices, those looking for immediate strategies for rapid financial growth may need to adjust their expectations when exploring his works.

Critics argue that the success of Warren Buffett is unique and may not be easily replicable by the average investor, despite the insights shared in his books.

Critics of Warren Buffett’s books contend that his success story is exceptional and may not be readily achievable by the average investor, even with the valuable insights provided in his writings. While Buffett’s principles and strategies are widely admired, some argue that his exceptional talent, experience, and access to resources play a significant role in his success, making it challenging for the average investor to replicate his achievements. Critics caution against assuming that following Buffett’s advice alone guarantees similar outcomes, emphasising the importance of individual circumstances and capabilities in achieving investment success.